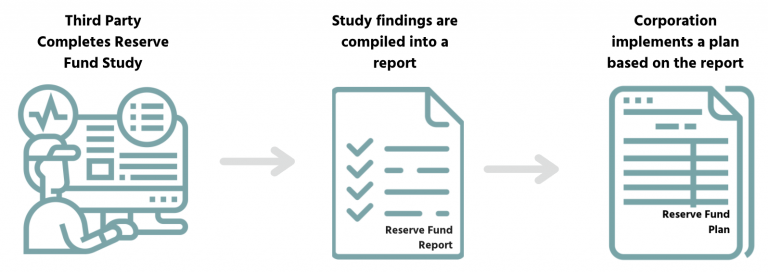

In Alberta, legislation speaks to the reserve fund study, the reserve fund report, and the reserve fund plan. These three terms are often used interchangeably but legislation defines them uniquely.

1. The Reserve Fund Study: Collection of data

A reserve fund study provider will collect relevant data through observations, review of documents, and correspondence with stakeholders. The provider needs the financial elements, and to identify building components, discern their quantity, verify the current costs to replace, and estimate replacement timing. Then the financial characteristics must be determined, the balance, past contributions, and interest earnings.

2. The Reserve Fund Report: Presentation of data

The report is what gets submitted to the client. It should contain things like a summary of the findings, the author’s recommendations, and qualifications. The report should be laid out logically, and convey enough information that the reader can understand how the author arrived at their conclusions.

3. The Reserve Fund Plan: Action taken by the corporation

The corporation is ultimately responsible for the management of the reserve fund. Legislation requires that the board approve a reserve fund plan based on the reserve fund report. The reserve fund plan can be viewed as the budget. It outlines the revenues and planned expenses for the reserve fund and indicates how the contributions will be imposed on owners. AR 168/2000 s.23(6) requires that the Reserve Fund Plan be shared with owners before collection of contributions.

For more information or detail on the above, an excerpt of the Alberta Condominium Regulation can be observed by clicking here. You can also download the Entire Act and Regulation by visiting Alberta Queens Printer